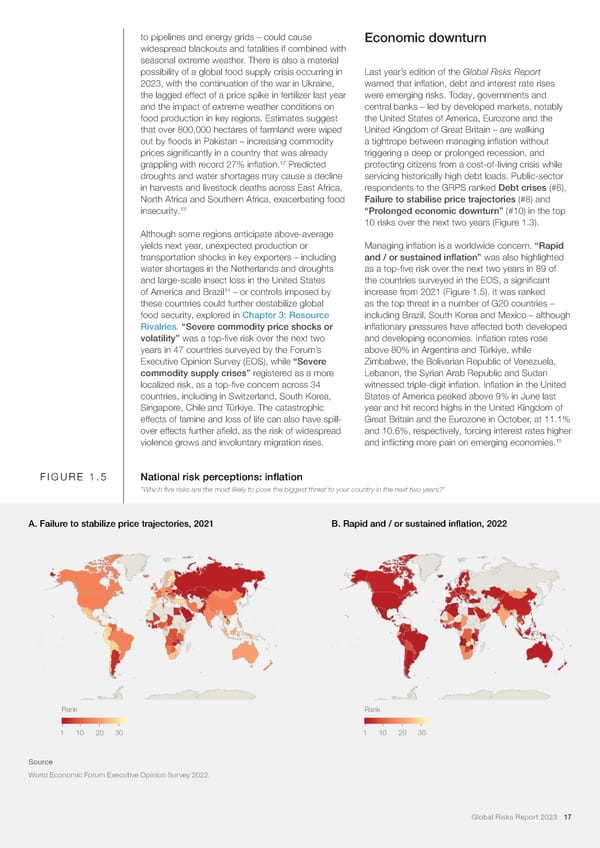

to pipelines and energy grids – could cause Economic downturn widespread blackouts and fatalities if combined with seasonal extreme weather. There is also a material possibility of a global food supply crisis occurring in Last year’s edition of the Global Risks Report 2023, with the continuation of the war in Ukraine, warned that in昀氀ation, debt and interest rate rises the lagged effect of a price spike in fertilizer last year were emerging risks. Today, governments and and the impact of extreme weather conditions on central banks – led by developed markets, notably food production in key regions. Estimates suggest the United States of America, Eurozone and the that over 800,000 hectares of farmland were wiped United Kingdom of Great Britain – are walking out by 昀氀oods in Pakistan – increasing commodity a tightrope between managing in昀氀ation without prices signi昀椀cantly in a country that was already triggering a deep or prolonged recession, and 12 grappling with record 27% in昀氀ation. Predicted protecting citizens from a cost-of-living crisis while droughts and water shortages may cause a decline servicing historically high debt loads. Public-sector in harvests and livestock deaths across East Africa, respondents to the GRPS ranked Debt crises (#6), North Africa and Southern Africa, exacerbating food Failure to stabilise price trajectories (#8) and 13 insecurity. “Prolonged economic downturn” (#10) in the top 10 risks over the next two years (Figure 1.3). Although some regions anticipate above-average yields next year, unexpected production or Managing in昀氀ation is a worldwide concern. “Rapid transportation shocks in key exporters – including and / or sustained in昀氀ation” was also highlighted water shortages in the Netherlands and droughts as a top-昀椀ve risk over the next two years in 89 of and large-scale insect loss in the United States the countries surveyed in the EOS, a signi昀椀cant 14 of America and Brazil – or controls imposed by increase from 2021 (Figure 1.5). It was ranked these countries could further destabilize global as the top threat in a number of G20 countries – food security, explored in Chapter 3: Resource including Brazil, South Korea and Mexico – although Rivalries. “Severe commodity price shocks or in昀氀ationary pressures have affected both developed volatility” was a top-昀椀ve risk over the next two and developing economies. In昀氀ation rates rose years in 47 countries surveyed by the Forum’s above 80% in Argentina and Türkiye, while Executive Opinion Survey (EOS), while “Severe Zimbabwe, the Bolivarian Republic of Venezuela, commodity supply crises” registered as a more Lebanon, the Syrian Arab Republic and Sudan localized risk, as a top-昀椀ve concern across 34 witnessed triple-digit in昀氀ation. In昀氀ation in the United countries, including in Switzerland, South Korea, States of America peaked above 9% in June last Singapore, Chile and Türkiye. The catastrophic year and hit record highs in the United Kingdom of effects of famine and loss of life can also have spill- Great Britain and the Eurozone in October, at 11.1% over effects further a昀椀eld, as the risk of widespread and 10.6%, respectively, forcing interest rates higher violence grows and involuntary migration rises. and in昀氀icting more pain on emerging economies.15 FIGURE 1.5 National risk perceptions: inflation "Which five risks are the most likely to pose the biggest threat to your country in the next two years?" A. Failure to stabilize price trajectories, 2021 B. Rapid and / or sustained inflation, 2022 Rank Rank 1 10 20 30 1 10 20 30 Source World Economic Forum Executive Opinion Survey 2022. Global Risks Report 2023 17

2023 | Global Risks Report Page 16 Page 18

2023 | Global Risks Report Page 16 Page 18