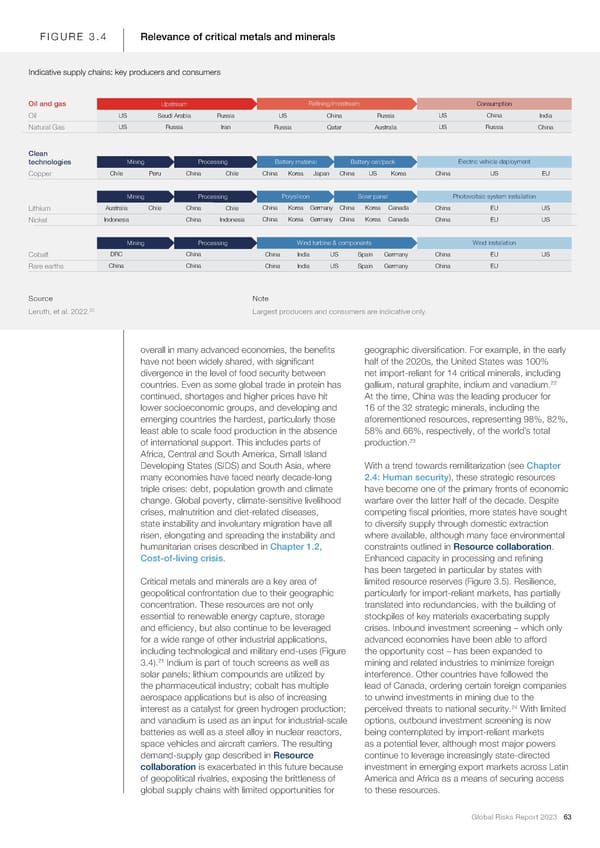

FIGURE 3.4 Relevance of critical metals and minerals Indicative supply chains: key producers and consumers Oil and gas Upstream Refining/minstream Consumption Oil US Saudi Arabia Russia US China Russia US China India Natural Gas US Russia Iran Russia Qatar Australia US Russia China Clean technologies Mining Processing Battery material Battery cell/pack Electric vehicle deployment Copper Chile Peru China Chile China Korea Japan China US Korea China US EU Mining Processing Polysilicon Solar panel Photovoltaic system installation Lithium Australia Chile China Chile China Korea Germany China Korea Canada China EU US Nickel Indonesia China Indonesia China Korea Germany China Korea Canada China EU US Mining Processing Wind turbine & components Wind installation Cobalt DRC China China India US Spain Germany China EU US Rare earths China China China India US Spain Germany China EU Source Note Leruth, et al. 2022.20 Largest producers and consumers are indicative only. overall in many advanced economies, the bene昀椀ts geographic diversi昀椀cation. For example, in the early have not been widely shared, with signi昀椀cant half of the 2020s, the United States was 100% divergence in the level of food security between net import-reliant for 14 critical minerals, including 22 countries. Even as some global trade in protein has gallium, natural graphite, indium and vanadium. continued, shortages and higher prices have hit At the time, China was the leading producer for lower socioeconomic groups, and developing and 16 of the 32 strategic minerals, including the emerging countries the hardest, particularly those aforementioned resources, representing 98%, 82%, least able to scale food production in the absence 58% and 66%, respectively, of the world’s total 23 of international support. This includes parts of production. Africa, Central and South America, Small Island Developing States (SIDS) and South Asia, where With a trend towards remilitarization (see Chapter many economies have faced nearly decade-long 2.4: Human security), these strategic resources triple crises: debt, population growth and climate have become one of the primary fronts of economic change. Global poverty, climate-sensitive livelihood warfare over the latter half of the decade. Despite crises, malnutrition and diet-related diseases, competing 昀椀scal priorities, more states have sought state instability and involuntary migration have all to diversify supply through domestic extraction risen, elongating and spreading the instability and where available, although many face environmental humanitarian crises described in Chapter 1.2, constraints outlined in Resource collaboration. Cost-of-living crisis. Enhanced capacity in processing and re昀椀ning has been targeted in particular by states with Critical metals and minerals are a key area of limited resource reserves (Figure 3.5). Resilience, geopolitical confrontation due to their geographic particularly for import-reliant markets, has partially concentration. These resources are not only translated into redundancies, with the building of essential to renewable energy capture, storage stockpiles of key materials exacerbating supply and ef昀椀ciency, but also continue to be leveraged crises. Inbound investment screening – which only for a wide range of other industrial applications, advanced economies have been able to afford including technological and military end-uses (Figure the opportunity cost – has been expanded to 21 3.4). Indium is part of touch screens as well as mining and related industries to minimize foreign solar panels; lithium compounds are utilized by interference. Other countries have followed the the pharmaceutical industry; cobalt has multiple lead of Canada, ordering certain foreign companies aerospace applications but is also of increasing to unwind investments in mining due to the 24 interest as a catalyst for green hydrogen production; perceived threats to national security. With limited and vanadium is used as an input for industrial-scale options, outbound investment screening is now batteries as well as a steel alloy in nuclear reactors, being contemplated by import-reliant markets space vehicles and aircraft carriers. The resulting as a potential lever, although most major powers demand-supply gap described in Resource continue to leverage increasingly state-directed collaboration is exacerbated in this future because investment in emerging export markets across Latin of geopolitical rivalries, exposing the brittleness of America and Africa as a means of securing access global supply chains with limited opportunities for to these resources. Global Risks Report 2023 63

2023 | Global Risks Report Page 62 Page 64

2023 | Global Risks Report Page 62 Page 64