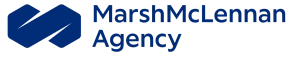

FIGURE 1.3 Severity by stakeholder over the short term (2 years) Government Business 1 Cost-of-living crisis 1 Cost-of-living crisis 2 Natural disasters and extreme weather 2 Natural disasters and extreme weather 3 Failure to mitigate climate change 3 Geoeconomic confrontation 4 Geoeconomic confrontation 4 Widespread cybercrime and cyber insecurity 5 Failure of climate-change adaption 5 Large-scale environmental damage incidents 6 Debt crises 6 Erosion of social cohesion and societal polarization 7 Erosion of social cohesion and societal 7 Failure to mitigate climate change polarization 8 Failure to stabilize price trajectories 8 Natural resource crises 9 Widespread cybercrime and cyber insecurity 9 Debt crises 10 Prolonged economic downturn 10 Failure of climate-change adaption Risk categories Economic Environmental Geopolitical Societal Technological Source World Economic Forum Global Risks Perception Survey 2022-2023. global risks that many expect to play out over the Although global supply chains have partly adapted, next two years, within the context of the mounting with pressures signi昀椀cantly lower than the peak 3 impacts and constraints being imposed by the experienced in April last year, price shocks to core numerous crises felt today. These are: cost-of-living necessities have signi昀椀cantly outpaced general crisis, economic downturn, geoeconomic warfare, in昀氀ation over this time (Figure 1.4). The FAO Price climate action hiatus and societal polarization. We Index hit the highest level since its inception in 1990 4 describe current trends associated with each risk, in March last year. Energy prices are estimated to brie昀氀y cover the reasons behind them and then note remain 46% higher than average in 2023 relative their emerging implications and knock-on effects. to January 2022 projections.5 The relaxation of China's COVID-19 policies could drive up energy and commodity prices further - and will test the Cost-of-living crisis resilience of global supply chains if policy changes remain unpredictable as infections soar. Ranked as the most severe global risk over the next Cost-of-living crisis was broadly perceived by two years by GRPS respondents, a global Cost-of- GRPS respondents to be a short-term risk, at peak living crisis is already here, with in昀氀ationary pressures severity within the next two years and easing off disproportionately hitting those that can least afford thereafter. But the persistence of a global cost-of- it. Even before the COVID-19 pandemic, the price living crisis could result in a growing proportion of of basic necessities – non-expendable items such the most vulnerable parts of society being priced out 1 as food and housing – were on the rise. Costs of access to basic needs, fueling unrest and political further increased in 2022, primarily due to continued instability. Continued supply-chain disruptions disruptions in the 昀氀ows of energy and food from could lead to sticky core in昀氀ation, particularly in Russia and Ukraine. To curb domestic prices, around food and energy. This could fuel further interest rate 30 countries introduced restrictions, including export hikes, raising the risk of debt distress, a prolonged bans, in food and energy last year, further driving economic downturn and a vicious cycle for 昀椀scal 2 up global in昀氀ation. Despite the latest extension, the planning. looming threat of Russia pulling out of the Black Sea Grain Export Deal has also led to signi昀椀cant volatility in Despite some improvement during the pandemic, the price of essential commodities. household debt has been on the rise in certain Global Risks Report 2023 15

2023 | Global Risks Report Page 14 Page 16

2023 | Global Risks Report Page 14 Page 16