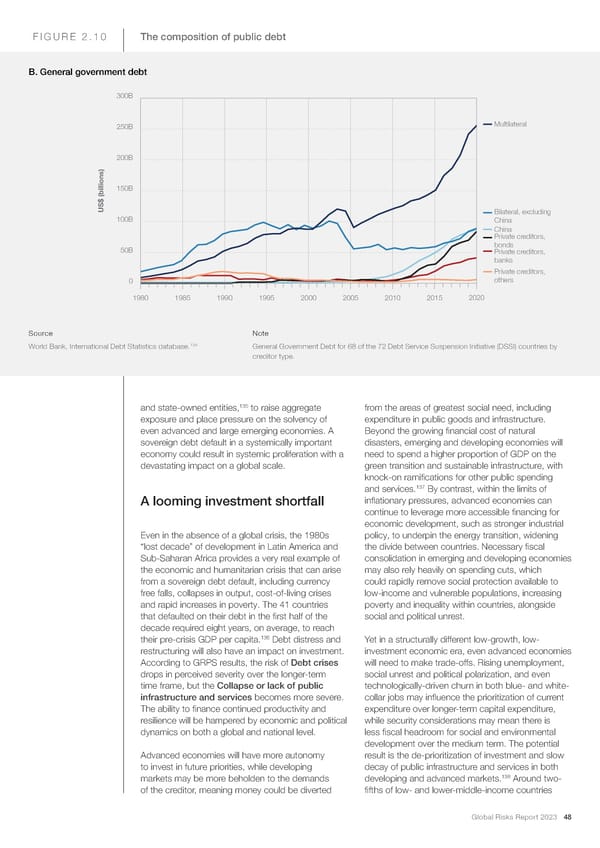

FIGURE 2.10 The composition of public debt B. General government debt 300B 250B Multilateral 200B 150B US$ (billions) Bilateral, excluding 100B China China Private creditors, 50B bonds Private creditors, banks Private creditors, 0 others 1980 1985 1990 1995 2000 2005 2010 2015 2020 Source Note World Bank, International Debt Statistics database.134 General Government Debt for 68 of the 72 Debt Service Suspension Initiative (DSSI) countries by creditor type. 135 and state-owned entities, to raise aggregate from the areas of greatest social need, including exposure and place pressure on the solvency of expenditure in public goods and infrastructure. even advanced and large emerging economies. A Beyond the growing 昀椀nancial cost of natural sovereign debt default in a systemically important disasters, emerging and developing economies will economy could result in systemic proliferation with a need to spend a higher proportion of GDP on the devastating impact on a global scale. green transition and sustainable infrastructure, with knock-on rami昀椀cations for other public spending 137 and services. By contrast, within the limits of A looming investment shortfall in昀氀ationary pressures, advanced economies can continue to leverage more accessible 昀椀nancing for economic development, such as stronger industrial Even in the absence of a global crisis, the 1980s policy, to underpin the energy transition, widening “lost decade” of development in Latin America and the divide between countries. Necessary 昀椀scal Sub-Saharan Africa provides a very real example of consolidation in emerging and developing economies the economic and humanitarian crisis that can arise may also rely heavily on spending cuts, which from a sovereign debt default, including currency could rapidly remove social protection available to free falls, collapses in output, cost-of-living crises low-income and vulnerable populations, increasing and rapid increases in poverty. The 41 countries poverty and inequality within countries, alongside that defaulted on their debt in the 昀椀rst half of the social and political unrest. decade required eight years, on average, to reach 136 their pre-crisis GDP per capita. Debt distress and Yet in a structurally different low-growth, low- restructuring will also have an impact on investment. investment economic era, even advanced economies According to GRPS results, the risk of Debt crises will need to make trade-offs. Rising unemployment, drops in perceived severity over the longer-term social unrest and political polarization, and even time frame, but the Collapse or lack of public technologically-driven churn in both blue- and white- infrastructure and services becomes more severe. collar jobs may in昀氀uence the prioritization of current The ability to 昀椀nance continued productivity and expenditure over longer-term capital expenditure, resilience will be hampered by economic and political while security considerations may mean there is dynamics on both a global and national level. less 昀椀scal headroom for social and environmental development over the medium term. The potential Advanced economies will have more autonomy result is the de-prioritization of investment and slow to invest in future priorities, while developing decay of public infrastructure and services in both 138 markets may be more beholden to the demands developing and advanced markets. Around two- of the creditor, meaning money could be diverted 昀椀fths of low- and lower-middle-income countries Global Risks Report 2023 48

2023 | Global Risks Report Page 47 Page 49

2023 | Global Risks Report Page 47 Page 49