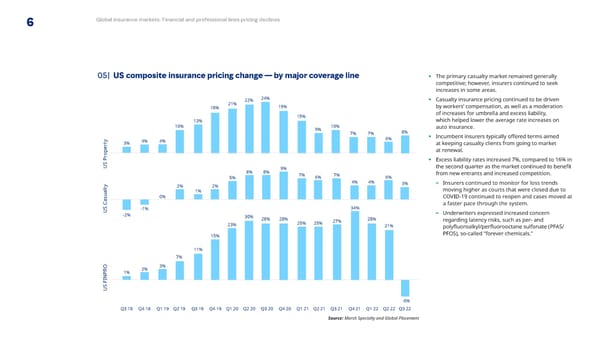

6 Global insurance markets: Financial and professional lines pricing declines 05| US composite insurance pricing change — by major coverage line • The primary casualty market remained generally competitive; however, insurers continued to seek increases in some areas. 22% 24% • Casualty insurance pricing continued to be driven 18% 21% 19% by workers’ compensation, as well as a moderation 15% of increases for umbrella and excess liability, 13% which helped lower the average rate increases on 10% 9% 10% auto insurance. 7% 7% 8% • Incumbent insurers typically o昀昀ered terms aimed y 4% 4% 6% t 3% at keeping casualty clients from going to market r e at renewal. p o r • Excess liability rates increased 7%, compared to 16% in S P U 9% the second quarter as the market continued to bene昀椀t 8% 8% 7% 7% from new entrants and increased competition. 5% 6% 6% y 2% 2% 4% 4% 3% – Insurers continued to monitor for loss trends t l 1% moving higher as courts that were closed due to a u 0% COVID-19 continued to reopen and cases moved at as a faster pace through the system. C 34% US -1% – Underwriters expressed increased concern -2% 30% 28% 28% 28% regarding latency risks, such as per- and 23% 25% 25% 27% 21% poly昀氀uoroalkyl/per昀氀uorooctane sulfonate (PFAS/ 15% PFOS), so-called “forever chemicals.” 11% 7% O 2% 3% R 1% NP I F US -6% Q3 18 Q4 18 Q1 19 Q2 19 Q3 19 Q4 19 Q1 20 Q2 20 Q3 20 Q4 20 Q1 21 Q2 21 Q3 21 Q4 21 Q1 22 Q2 22 Q3 22 Source: Marsh Specialty and Global Placement

Q3 2022 | Global Insurance Market Index Page 5 Page 7

Q3 2022 | Global Insurance Market Index Page 5 Page 7