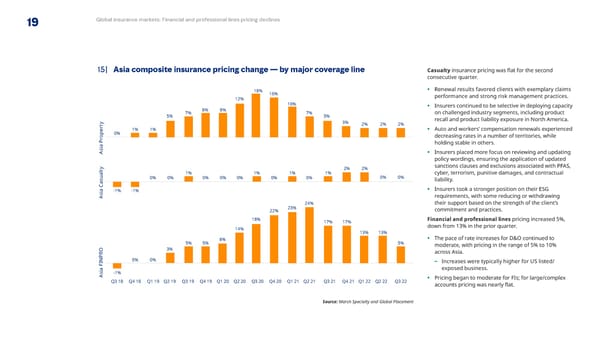

19 Global insurance markets: Financial and professional lines pricing declines 15| Asia composite insurance pricing change — by major coverage line Casualty insurance pricing was 昀氀at for the second consecutive quarter. 18% 16% • Renewal results favored clients with exemplary claims 12% performance and strong risk management practices. 10% • Insurers continued to be selective in deploying capacity 7% 8% 8% 7% on challenged industry segments, including product 5% 5% recall and product liability exposure in North America. y 3% 2% 2% 2% t r 1% 1% • Auto and workers’ compensation renewals experienced e p 0% decreasing rates in a number of territories, while o Pr holding stable in others. a si • Insurers placed more focus on reviewing and updating A policy wordings, ensuring the application of updated y 2% 2% sanctions clauses and exclusions associated with PFAS, lt 1% 1% 1% 1% cyber, terrorism, punitive damages, and contractual a u 0% 0% 0% 0% 0% 0% 0% 0% 0% s liability. Ca • Insurers took a stronger position on their ESG a -1% -1% i s requirements, with some reducing or withdrawing A 23% 24% their support based on the strength of the client’s 22% commitment and practices. 18% 17% 17% Financial and professional lines pricing increased 5%, 14% down from 13% in the prior quarter. 13% 13% 8% • The pace of rate increases for D&O continued to 5% 5% 5% moderate, with pricing in the range of 5% to 10% O 3% across Asia. R P N 0% 0% – Increases were typically higher for US listed/ I a F exposed business. i s -1% A • Pricing began to moderate for FIs; for large/complex Q3 18 Q4 18 Q1 19 Q2 19 Q3 19 Q4 19 Q1 20 Q2 20 Q3 20 Q4 20 Q1 21 Q2 21 Q3 21 Q4 21 Q1 22 Q2 22 Q3 22 accounts pricing was nearly 昀氀at. Source: Marsh Specialty and Global Placement

Q3 2022 | Global Insurance Market Index Page 18 Page 20

Q3 2022 | Global Insurance Market Index Page 18 Page 20