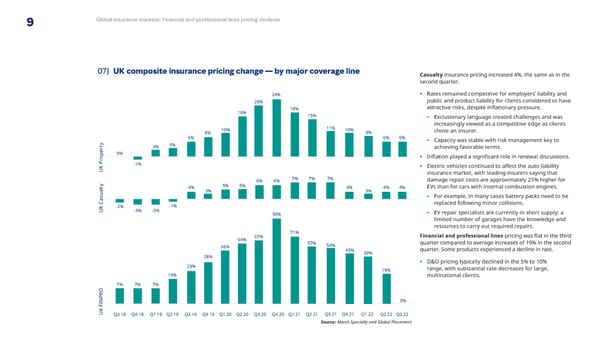

9 Global insurance markets: Financial and professional lines pricing declines 07| UK composite insurance pricing change — by major coverage line Casualty insurance pricing increased 4%, the same as in the second quarter. 24% • Rates remained competitive for employers’ liability and 20% public and product liability for clients considered to have 18% attractive risks, despite in昀氀ationary pressure. 16% 15% – Exclusionary language created challenges and was 11% increasingly viewed as a competitive edge as clients 8% 10% 10% 9% chose an insurer. y 6% 6% 6% – Capacity was stable with risk management key to t 3% 4% achieving favorable terms. r e 0% p • In昀氀ation played a signi昀椀cant role in renewal discussions. o r P -1% • Electric vehicles continued to a昀昀ect the auto liability UK insurance market, with leading insurers saying that y 6% 6% 7% 7% 7% damage repair costs are approximately 25% higher for lt 4% 5% 5% 4% 4% 4% EVs than for cars with internal combustion engines. a 3% 3% u – For example, in many cases battery packs need to be s Ca -2% -1% replaced following minor collisions. K -3% -3% U 90% – EV repair specialists are currently in short supply; a limited number of garages have the knowledge and resources to carry out required repairs. 67% 71% Financial and professional lines pricing was 昀氀at in the third 64% 57% quarter compared to average increases of 19% in the second 46% 54% quarter. Some products experienced a decline in rate. 43% 39% 28% • D&O pricing typically declined in the 5% to 10% 23% 19% range, with substantial rate decreases for large, 15% multinational clients. O 7% 7% 7% R P N 0% I K F U Q3 18 Q4 18 Q1 19 Q2 19 Q3 19 Q4 19 Q1 20 Q2 20 Q3 20 Q4 20 Q1 21 Q2 21 Q3 21 Q4 21 Q1 22 Q2 22 Q3 22 Source: Marsh Specialty and Global Placement

Q3 2022 | Global Insurance Market Index Page 8 Page 10

Q3 2022 | Global Insurance Market Index Page 8 Page 10