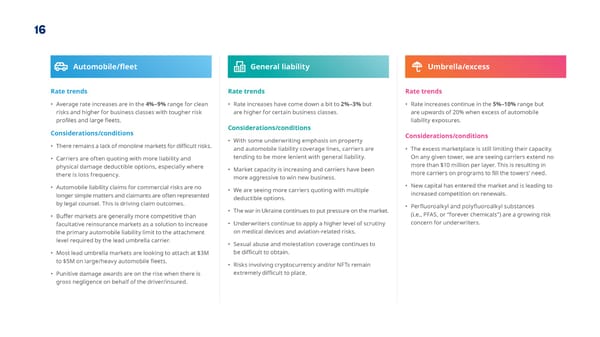

16 Automobile/昀氀eet General liability Umbrella/excess Rate trends Rate trends Rate trends • Average rate increases are in the 4%–9% range for clean • Rate increases have come down a bit to 2%–3% but • Rate increases continue in the 5%–10% range but risks and higher for business classes with tougher risk are higher for certain business classes. are upwards of 20% when excess of automobile pro昀椀les and large 昀氀eets. liability exposures. Considerations/conditions Considerations/conditions • With some underwriting emphasis on property Considerations/conditions • There remains a lack of monoline markets for di昀케cult risks. and automobile liability coverage lines, carriers are • The excess marketplace is still limiting their capacity. • Carriers are often quoting with more liability and tending to be more lenient with general liability. On any given tower, we are seeing carriers extend no physical damage deductible options, especially where • Market capacity is increasing and carriers have been more than $10 million per layer. This is resulting in there is loss frequency. more aggressive to win new business. more carriers on programs to 昀椀ll the towers’ need. • Automobile liability claims for commercial risks are no • We are seeing more carriers quoting with multiple • New capital has entered the market and is leading to longer simple matters and claimants are often represented deductible options. increased competition on renewals. by legal counsel. This is driving claim outcomes. • Per昀氀uoroalkyl and poly昀氀uoroalkyl substances • The war in Ukraine continues to put pressure on the market. • Bu昀昀er markets are generally more competitive than (i.e., PFAS, or “forever chemicals”) are a growing risk facultative reinsurance markets as a solution to increase • Underwriters continue to apply a higher level of scrutiny concern for underwriters. the primary automobile liability limit to the attachment on medical devices and aviation-related risks. level required by the lead umbrella carrier. • Sexual abuse and molestation coverage continues to • Most lead umbrella markets are looking to attach at $3M be di昀케cult to obtain. to $5M on large/heavy automobile 昀氀eets. • Risks involving cryptocurrency and/or NFTs remain • Punitive damage awards are on the rise when there is extremely di昀케cult to place. gross negligence on behalf of the driver/insured.

Year-end | State of the Market Report Page 16 Page 18

Year-end | State of the Market Report Page 16 Page 18