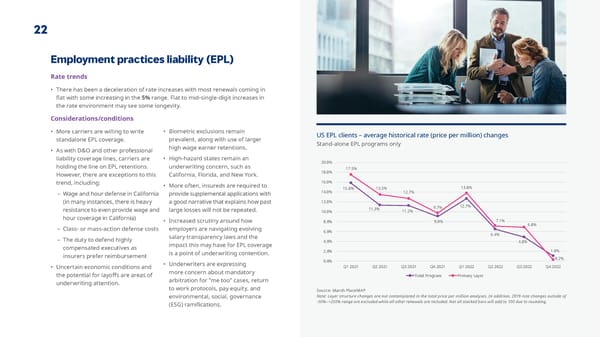

22 Employment practices liability (EPL) Rate trends • There has been a deceleration of rate increases with most renewals coming in 昀氀at with some increasing in the 5% range. Flat to mid-single-digit increases in the rate environment may see some longevity. Considerations/conditions • More carriers are willing to write • Biometric exclusions remain standalone EPL coverage. prevalent, along with use of larger US EPL clients – average historical rate (price per million) changes high wage earner retentions. Stand-alone EPL programs only • As with D&O and other professional liability coverage lines, carriers are • High-hazard states remain an 20.0% holding the line on EPL retentions. underwriting concern, such as 17.5% However, there are exceptions to this California, Florida, and New York. 18.0% trend, including: • More often, insureds are required to 16.0% 15.8% 13.5% 13.8% – Wage and hour defense in California provide supplemental applications with 14.0% 12.7% a good narrative that explains how past 12.0% (in many instances, there is heavy 12.7% resistance to even provide wage and large losses will not be repeated. 10.0% 11.3% 11.2% 9.7% hour coverage in California) • Increased scrutiny around how 8.0% 9.0% 7.1% – Class- or mass-action defense costs employers are navigating evolving 6.8% 6.0% 6.4% – The duty to defend highly salary transparency laws and the 4.0% 4.8% compensated executives as impact this may have for EPL coverage insurers prefer reimbursement is a point of underwriting contention. 2.0% 1.0% 0.0% 0.2% • Uncertain economic conditions and • Underwriters are expressing Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 more concern about mandatory the potential for layo昀昀s are areas of arbitration for "me too" cases, return Total Program Primary Layer underwriting attention. to work protocols, pay equity, and Source: Marsh PlaceMAP environmental, social, governance Note: Layer structure changes are not contemplated in the total price per million analyses. In addition, 2019 rate changes outside of -50%–+250% range are excluded while all other renewals are included. Not all stacked bars will add to 100 due to rounding. (ESG) rami昀椀cations.

Year-end | State of the Market Report Page 22 Page 24

Year-end | State of the Market Report Page 22 Page 24