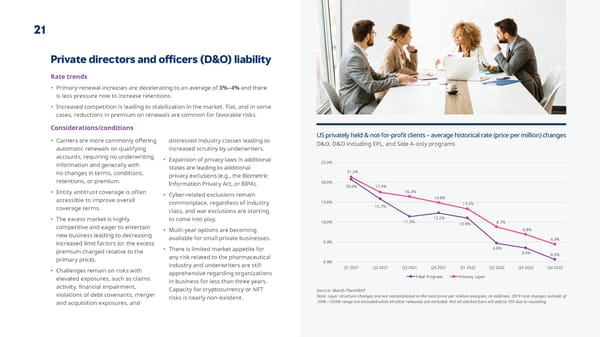

21 Private directors and o昀케cers (D&O) liability Rate trends • Primary renewal increases are decelerating to an average of 3%–4% and there is less pressure now to increase retentions. • Increased competition is leading to stabilization in the market. Flat, and in some cases, reductions in premium on renewals are common for favorable risks. Considerations/conditions • Carriers are more commonly o昀昀ering distressed industry classes leading to US privately held & not-for-pro昀椀t clients – average historical rate (price per million) changes automatic renewals on qualifying increased scrutiny by underwriters. D&O, D&O including EPL, and Side A-only programs accounts, requiring no underwriting • Expansion of privacy laws in additional information and generally with states are leading to additional 25.0% no changes in terms, conditions, 21.2% retentions, or premium. privacy exclusions (e.g., the Biometric 20.0% Information Privacy Act, or BIPA). 20.6% 17.4% • Entity antitrust coverage is often • Cyber-related exclusions remain 16.3% accessible to improve overall 14.8% commonplace, regardless of industry 15.0% 15.7% 13.2% coverage terms. class, and war exclusions are starting • The excess market is highly to come into play. 10.0% 11.3% 12.2% 8.7% competitive and eager to entertain 10.9% • Multi-year options are becoming 6.8% new business leading to decreasing available for small private businesses. 4.3% 5.0% increased limit factors (or the excess • There is limited market appetite for 4.6% premium charged relative to the any risk related to the pharmaceutical 3.4% 0.5% primary price). industry and underwriters are still 0.0% • Challenges remain on risks with Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 elevated exposures, such as claims apprehensive regarding organizations Total Program Primary Layer in business for less than three years. activity, 昀椀nancial impairment, Capacity for cryptocurrency or NFT Source: Marsh PlaceMAP violations of debt covenants, merger risks is nearly non-existent. Note: Layer structure changes are not contemplated in the total price per million analyses. In addition, 2019 rate changes outside of and acquisition exposures, and -50%–+250% range are excluded while all other renewals are included. Not all stacked bars will add to 100 due to rounding.

Year-end | State of the Market Report Page 21 Page 23

Year-end | State of the Market Report Page 21 Page 23