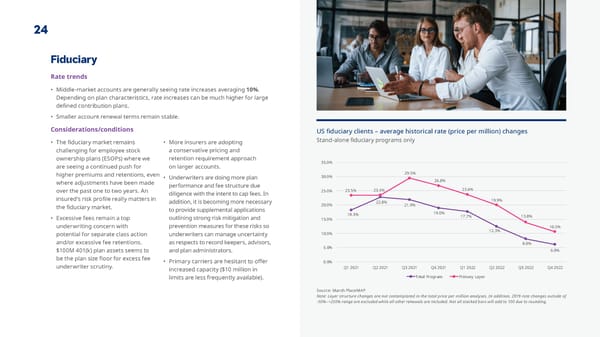

24 Fiduciary Rate trends • Middle-market accounts are generally seeing rate increases averaging 10%. Depending on plan characteristics, rate increases can be much higher for large de昀椀ned contribution plans. • Smaller account renewal terms remain stable. Considerations/conditions US 昀椀duciary clients – average historical rate (price per million) changes • The 昀椀duciary market remains • More insurers are adopting Stand-alone 昀椀duciary programs only challenging for employee stock a conservative pricing and ownership plans (ESOPs) where we retention requirement approach 35.0% are seeing a continued push for on larger accounts. higher premiums and retentions, even • Underwriters are doing more plan 30.0% 29.5% where adjustments have been made performance and fee structure due 26.8% over the past one to two years. An diligence with the intent to cap fees. In 25.0% 23.5% 23.4% 23.6% insured’s risk pro昀椀le really matters in addition, it is becoming more necessary 22.8% 19.9% 20.0% 21.9% the 昀椀duciary market. to provide supplemental applications • Excessive fees remain a top outlining strong risk mitigation and 18.3% 19.0% 17.7% 13.8% 15.0% underwriting concern with prevention measures for these risks so 12.3% 10.5% potential for separate class action underwriters can manage uncertainty 10.0% and/or excessive fee retentions. as respects to record keepers, advisors, 8.0% and plan administrators. 5.0% 6.0% $100M 401(k) plan assets seems to be the plan size 昀氀oor for excess fee • Primary carriers are hesitant to o昀昀er 0.0% underwriter scrutiny. Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 increased capacity ($10 million in Total Program Primary Layer limits are less frequently available). Source: Marsh PlaceMAP Note: Layer structure changes are not contemplated in the total price per million analyses. In addition, 2019 rate changes outside of -50%–+250% range are excluded while all other renewals are included. Not all stacked bars will add to 100 due to rounding.

Year-end | State of the Market Report Page 24 Page 26

Year-end | State of the Market Report Page 24 Page 26