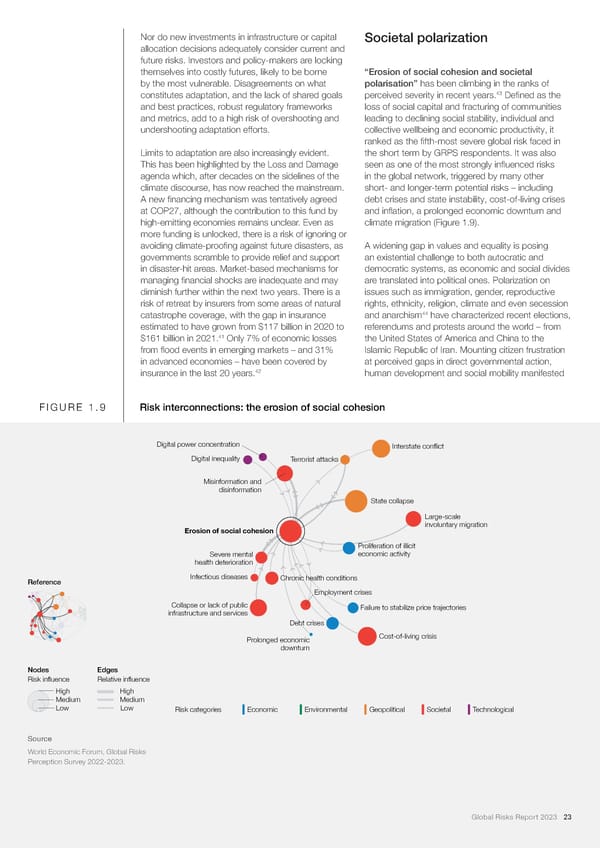

Nor do new investments in infrastructure or capital Societal polarization allocation decisions adequately consider current and future risks. Investors and policy-makers are locking themselves into costly futures, likely to be borne “Erosion of social cohesion and societal by the most vulnerable. Disagreements on what polarisation” has been climbing in the ranks of 43 constitutes adaptation, and the lack of shared goals perceived severity in recent years. De昀椀ned as the and best practices, robust regulatory frameworks loss of social capital and fracturing of communities and metrics, add to a high risk of overshooting and leading to declining social stability, individual and undershooting adaptation efforts. collective wellbeing and economic productivity, it ranked as the 昀椀fth-most severe global risk faced in Limits to adaptation are also increasingly evident. the short term by GRPS respondents. It was also This has been highlighted by the Loss and Damage seen as one of the most strongly in昀氀uenced risks agenda which, after decades on the sidelines of the in the global network, triggered by many other climate discourse, has now reached the mainstream. short- and longer-term potential risks – including A new 昀椀nancing mechanism was tentatively agreed debt crises and state instability, cost-of-living crises at COP27, although the contribution to this fund by and in昀氀ation, a prolonged economic downturn and high-emitting economies remains unclear. Even as climate migration (Figure 1.9). more funding is unlocked, there is a risk of ignoring or avoiding climate-proo昀椀ng against future disasters, as A widening gap in values and equality is posing governments scramble to provide relief and support an existential challenge to both autocratic and in disaster-hit areas. Market-based mechanisms for democratic systems, as economic and social divides managing 昀椀nancial shocks are inadequate and may are translated into political ones. Polarization on diminish further within the next two years. There is a issues such as immigration, gender, reproductive risk of retreat by insurers from some areas of natural rights, ethnicity, religion, climate and even secession catastrophe coverage, with the gap in insurance and anarchism44 have characterized recent elections, estimated to have grown from $117 billion in 2020 to referendums and protests around the world – from 41 $161 billion in 2021. Only 7% of economic losses the United States of America and China to the from 昀氀ood events in emerging markets – and 31% Islamic Republic of Iran. Mounting citizen frustration in advanced economies – have been covered by at perceived gaps in direct governmental action, 42 insurance in the last 20 years. human development and social mobility manifested FIGURE 1.9 Risk interconnections: the erosion of social cohesion Digital power concentration Interstate conflict Digital inequality Terrorist attacks Misinformation and disinformation State collapse Large-scale Erosion of social cohesion involuntary migration Proliferation of illicit Severe mental economic activity health deterioration Reference Infectious diseases Chronic health conditions Employment crises Collapse or lack of public Failure to stabilize price trajectories infrastructure and services Debt crises Prolonged economic Cost-of-living crisis downturn Nodes EdgesEdges Risk influence Relative influence High High Medium Medium Low Low Risk categories Economic Environmental Geopolitical Societal Technological Source World Economic Forum, Global Risks Perception Survey 2022-2023. Global Risks Report 2023 23

2023 | Global Risks Report Page 22 Page 24

2023 | Global Risks Report Page 22 Page 24