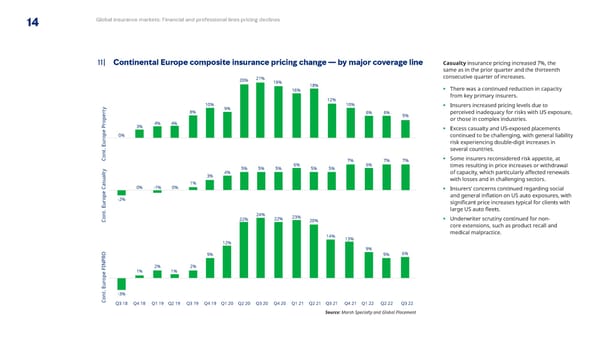

14 Global insurance markets: Financial and professional lines pricing declines 11| Continental Europe composite insurance pricing change — by major coverage line Casualty insurance pricing increased 7%, the same as in the prior quarter and the thirteenth 20% 21% consecutive quarter of increases. 19% 18% 16% • There was a continued reduction in capacity 12% from key primary insurers. y 10% 9% 10% • Insurers increased pricing levels due to t 8% r 6% 6% perceived inadequacy for risks with US exposure, e 5% or those in complex industries. op 4% 4% r 3% P • Excess casualty and US-exposed placements e op 0% continued to be challenging, with general liability r u risk experiencing double-digit increases in E . several countries. t on • Some insurers reconsidered risk appetite, at C 7% 7% 7% y 5% 5% 5% 6% 5% 5% 6% times resulting in price increases or withdrawal t 4% l 3% of capacity, which particularly a昀昀ected renewals a with losses and in challenging sectors. u s 1% a 0% -1% 0% • Insurers’ concerns continued regarding social e C p o -2% and general in昀氀ation on US auto exposures, with r u signi昀椀cant price increases typical for clients with . E t large US auto 昀氀eets. n 24% 23% o 22% 22% 20% • Underwriter scrutiny continued for non- C core extensions, such as product recall and 14% medical malpractice. 12% 13% 9% O 5% 5% 6% R P IN 2% 2% F 1% 1% e op r u E . t -3% on C Q3 18 Q4 18 Q1 19 Q2 19 Q3 19 Q4 19 Q1 20 Q2 20 Q3 20 Q4 20 Q1 21 Q2 21 Q3 21 Q4 21 Q1 22 Q2 22 Q3 22 Source: Marsh Specialty and Global Placement

Q3 2022 | Global Insurance Market Index Page 13 Page 15

Q3 2022 | Global Insurance Market Index Page 13 Page 15