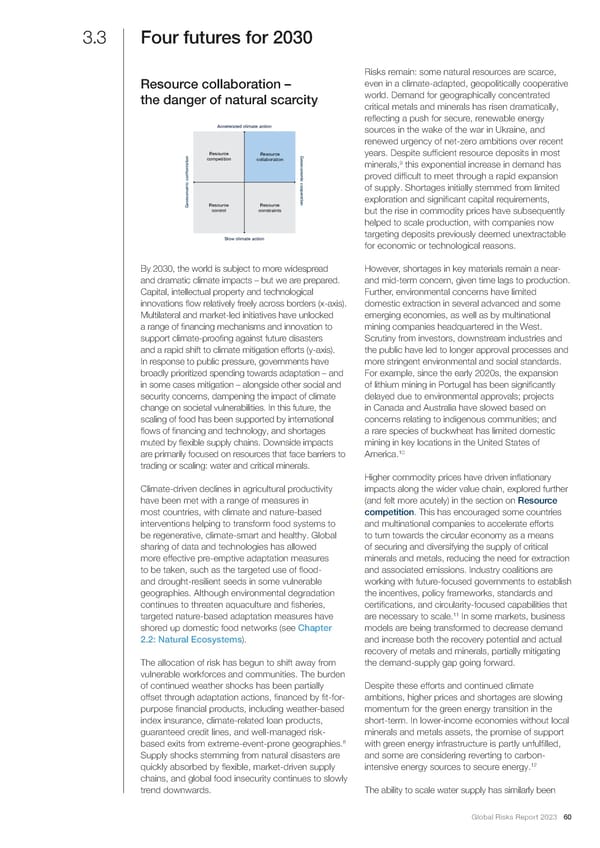

3.3 Four futures for 2030 Risks remain: some natural resources are scarce, Resource collaboration – even in a climate-adapted, geopolitically cooperative the danger of natural scarcity world. Demand for geographically concentrated critical metals and minerals has risen dramatically, re昀氀ecting a push for secure, renewable energy Accelerated climate action sources in the wake of the war in Ukraine, and renewed urgency of net-zero ambitions over recent Resource Resource Geoeconomic cooperationyears. Despite suf昀椀cient resource deposits in most competition collaboration 9 minerals, this exponential increase in demand has ontation proved dif昀椀cult to meet through a rapid expansion of supply. Shortages initially stemmed from limited exploration and signi昀椀cant capital requirements, Geoeconomic confrResourceResource control constraints but the rise in commodity prices have subsequently helped to scale production, with companies now Slow climate action targeting deposits previously deemed unextractable for economic or technological reasons. By 2030, the world is subject to more widespread However, shortages in key materials remain a near- and dramatic climate impacts – but we are prepared. and mid-term concern, given time lags to production. Capital, intellectual property and technological Further, environmental concerns have limited innovations 昀氀ow relatively freely across borders (x-axis). domestic extraction in several advanced and some Multilateral and market-led initiatives have unlocked emerging economies, as well as by multinational a range of 昀椀nancing mechanisms and innovation to mining companies headquartered in the West. support climate-proo昀椀ng against future disasters Scrutiny from investors, downstream industries and and a rapid shift to climate mitigation efforts (y-axis). the public have led to longer approval processes and In response to public pressure, governments have more stringent environmental and social standards. broadly prioritized spending towards adaptation – and For example, since the early 2020s, the expansion in some cases mitigation – alongside other social and of lithium mining in Portugal has been signi昀椀cantly security concerns, dampening the impact of climate delayed due to environmental approvals; projects change on societal vulnerabilities. In this future, the in Canada and Australia have slowed based on scaling of food has been supported by international concerns relating to indigenous communities; and 昀氀ows of 昀椀nancing and technology, and shortages a rare species of buckwheat has limited domestic muted by 昀氀exible supply chains. Downside impacts mining in key locations in the United States of are primarily focused on resources that face barriers to America.10 trading or scaling: water and critical minerals. Higher commodity prices have driven in昀氀ationary Climate-driven declines in agricultural productivity impacts along the wider value chain, explored further have been met with a range of measures in (and felt more acutely) in the section on Resource most countries, with climate and nature-based competition. This has encouraged some countries interventions helping to transform food systems to and multinational companies to accelerate efforts be regenerative, climate-smart and healthy. Global to turn towards the circular economy as a means sharing of data and technologies has allowed of securing and diversifying the supply of critical more effective pre-emptive adaptation measures minerals and metals, reducing the need for extraction to be taken, such as the targeted use of 昀氀ood- and associated emissions. Industry coalitions are and drought-resilient seeds in some vulnerable working with future-focused governments to establish geographies. Although environmental degradation the incentives, policy frameworks, standards and continues to threaten aquaculture and 昀椀sheries, certi昀椀cations, and circularity-focused capabilities that 11 targeted nature-based adaptation measures have are necessary to scale. In some markets, business shored up domestic food networks (see Chapter models are being transformed to decrease demand 2.2: Natural Ecosystems). and increase both the recovery potential and actual recovery of metals and minerals, partially mitigating The allocation of risk has begun to shift away from the demand-supply gap going forward. vulnerable workforces and communities. The burden of continued weather shocks has been partially Despite these efforts and continued climate offset through adaptation actions, 昀椀nanced by 昀椀t-for- ambitions, higher prices and shortages are slowing purpose 昀椀nancial products, including weather-based momentum for the green energy transition in the index insurance, climate-related loan products, short-term. In lower-income economies without local guaranteed credit lines, and well-managed risk- minerals and metals assets, the promise of support 8 based exits from extreme-event-prone geographies. with green energy infrastructure is partly unful昀椀lled, Supply shocks stemming from natural disasters are and some are considering reverting to carbon- quickly absorbed by 昀氀exible, market-driven supply intensive energy sources to secure energy.12 chains, and global food insecurity continues to slowly trend downwards. The ability to scale water supply has similarly been Global Risks Report 2023 60

2023 | Global Risks Report Page 59 Page 61

2023 | Global Risks Report Page 59 Page 61