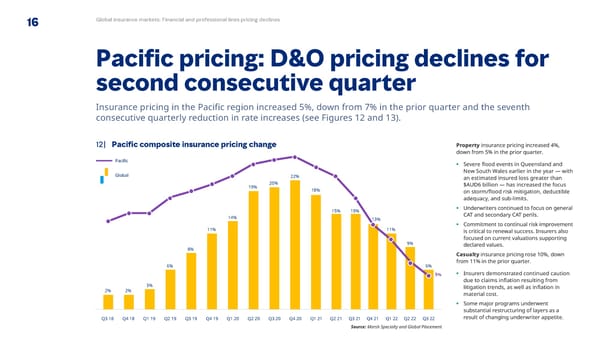

16 Global insurance markets: Financial and professional lines pricing declines Paci昀椀c pricing: D&O pricing declines for second consecutive quarter Insurance pricing in the Paci昀椀c region increased 5%, down from 7% in the prior quarter and the seventh consecutive quarterly reduction in rate increases (see Figures 12 and 13). 12| Paci昀椀c composite insurance pricing change Property insurance pricing increased 4%, down from 5% in the prior quarter. Paci昀椀c • Severe 昀氀ood events in Queensland and Global New South Wales earlier in the year — with 22% an estimated insured loss greater than 19% 20% $AUD6 billion — has increased the focus 18% on storm/昀氀ood risk mitigation, deductible adequacy, and sub-limits. 15% 15% • Underwriters continued to focus on general 14% 13% CAT and secondary CAT perils. 11% 11% • Commitment to continual risk improvement is critical to renewal success. Insurers also focused on current valuations supporting 9% declared values. 8% Casualty insurance pricing rose 10%, down 6% 6% from 11% in the prior quarter. 5% • Insurers demonstrated continued caution due to claims in昀氀ation resulting from 3% 2% 2% litigation trends, as well as in昀氀ation in material cost. • Some major programs underwent substantial restructuring of layers as a Q3 18 Q4 18 Q1 19 Q2 19 Q3 19 Q4 19 Q1 20 Q2 20 Q3 20 Q4 20 Q1 21 Q2 21 Q3 21 Q4 21 Q1 22 Q2 22 Q3 22 result of changing underwriter appetite. Source: Marsh Specialty and Global Placement

Q3 2022 | Global Insurance Market Index Page 15 Page 17

Q3 2022 | Global Insurance Market Index Page 15 Page 17